Reporting Engine

A reporting engine for a publicly traded company in the highly regulated financial industry.

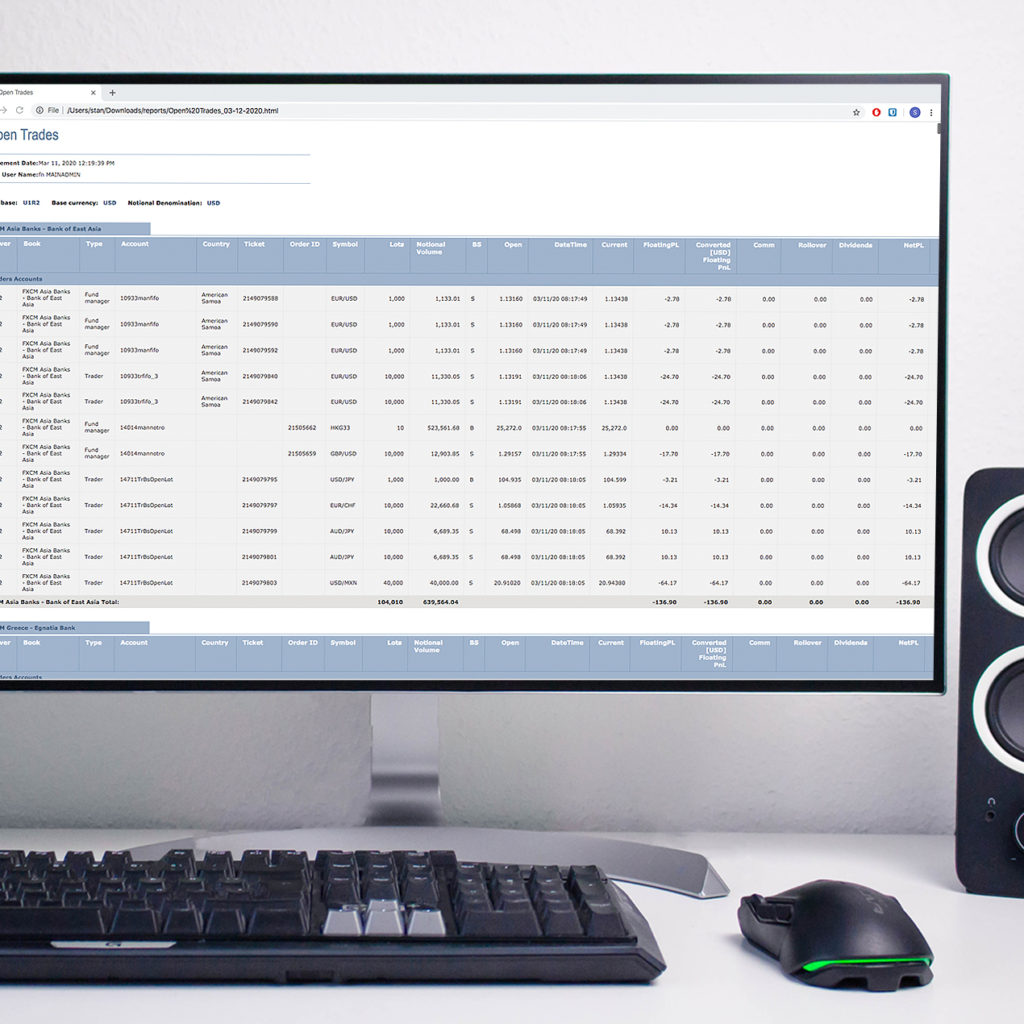

Build a reporting system for a highly regulated Forex brokerage, a public company that operates in 190 countries. One requirement was the ability to submit large, ongoing reports to the appropriate government agencies. This included over 600 different PDF reports, some of them hundreds or thousands pages long. Regulatory bodies and regulations include CFTC, NFA, FCA, ASIC, MIFID II.

The new reporting engine meant PDF reports could be generated and submitted instead of printed paper reports. Prior to 2005 and the engine’s creation, a system didn’t exist that could create reports of this magnitude. FintechOps created our own proprietary streaming PDF generation technology that could generate large PDFs quickly without requiring a large amount of server RAM.

Additionally, we built a special warehousing solution to store pre-calculated and pre-aggregated data in a format better suited to generating reports. This solution lives separately from the set of 150 databases that store and provide live data to traders and trading platforms in real time. Intellectual data replication occurring between the real-time database and the warehouse only takes place when the live database isn’t being consumed by live requests. Reports are now generated with the push of a button, then sent to the regulatory body.

- Regardless of size, at the push of a button, the brokerage could now electronically submit all mandatory reports in PDF. There was no longer a need to physically courier large, printed documents.

- Partner brokerages using the white label platform were able to customize their reports to match their personal brand

- New types of reports were quickly adopted when FXCM became a publicly traded company.

- 1st Streaming PDF Engine

- 150 Database Aggregation

- 1,000,000 Lines of Code